Donations that reaps tax benefits

One of our goals is to make giving cash donations to Catholic Charities as easy and convenient as possible for those who graciously choose to partner with us in this way. One popular method of giving that reaps tax benefits for the investor is the donor advised fund. We are thankful to have several donors directing their donor advised fund contributions to Catholic Charities, and thought it pertinent to share a few facts about this vehicle for giving.

For those with established donor advised funds, we pray you will consider Catholic Charities as a recipient of your contributions.

I would be happy to answer any questions you may have about directing your donor advised fund contributions to Catholic Charities. You may reach me at 316-264-8344, ext. 1222.

Lindsi Bachman, Director of Development

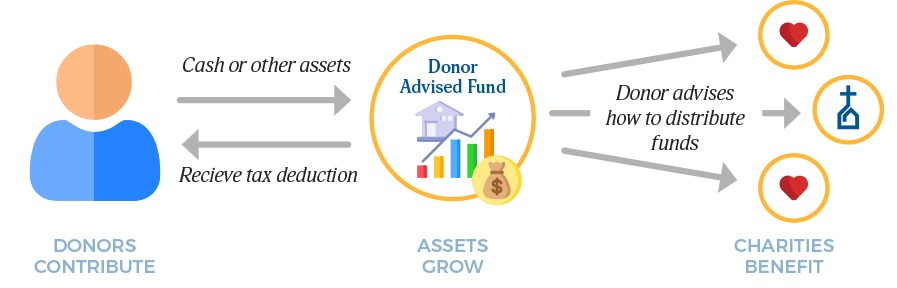

How a Donor Advised Fund works

Individuals and/or couples put money into an investment fund with a sponsoring organization such as, Fidelity Charitable, Charles Schwab or a community foundation. The fund grows over time allowing donors to direct the accrual amount to a charity of their choosing, such as Catholic Charities. Donors receive tax benefits upon their initial investment.

Facts to consider

- The standard minimum deduction increased in 2018, making it more beneficial to give a large sum of money all at once.

- You can set up a recurring gift schedule for your donor advised fund contributions with Catholic Charities as the beneficiary.

- Some employers will match your donor advised fund contributions to not-for-profit organizations, such as Catholic Charities.

-

Two thirds of 2021 investments to donor advised funds at FidelityCharitable and Charles Schwab were non-cash gifts. These financialinstitutions make it easy and convenient to use stock and crypto currency as an initial investment to a donor advised fund. Contact your financial advisor for more information.

Learn more about giving opportunities

Contact Us

We would like to hear from you! Call 316-264-8344 or Email us:

Services

Counseling And Immigration

Disabled Adults And Seniors

Hunger

Domestic Violence

St. Joseph Pastoral Center

437 North Topeka st.

Wichita. KS 67202-2431

(316) 264-8344

Catholic Charities, Diocese of Wichita is a 501(c)(3). All gifts are tax-deductible.

Need donation support?

316-264-8344 ext. 1262

giving@CatholicCharitiesWichita.org

Wichita Diocese

The Wichita Diocese covers 20,021 square miles and includes 25 counties in the southeast corner of the state. It is home to over 114,000 Catholics in 90 parishes.